AILIFEBOT was born out of a thesis that chat or messaging will rule the 21st-century smartphone world. We started in 2013, way before chatbots became popular.

submitted by /u/kanoh64748

[link] [comments]

AILIFEBOT was born out of a thesis that chat or messaging will rule the 21st-century smartphone world. We started in 2013, way before chatbots became popular.

submitted by /u/kanoh64748

[link] [comments]

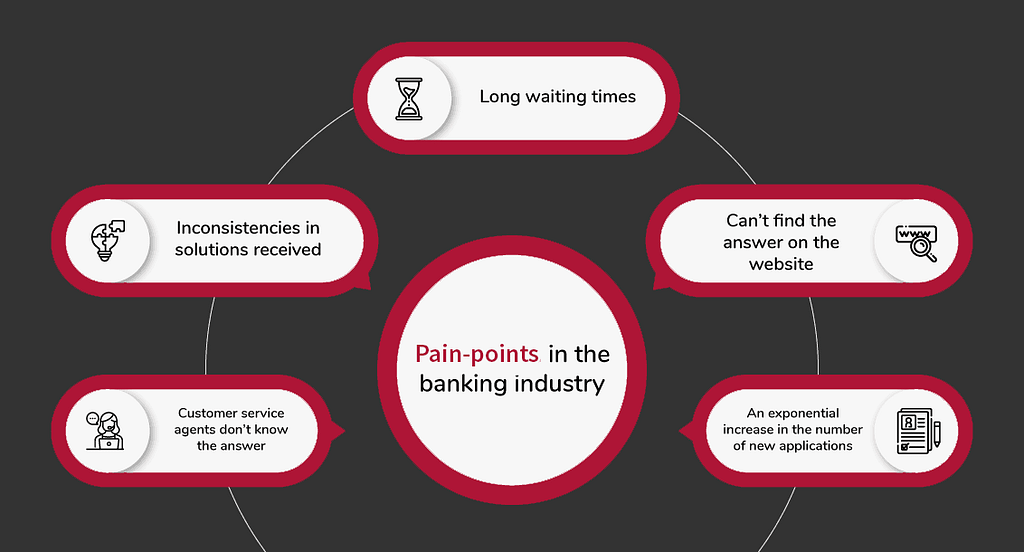

The best service a bank can offer to its customers is one that’s meaningful, engaging, and personalized. Chatbots in banking have huge potential for customer engagement. It gives customers 24/7 access to support and banks can make great use of AI and improve customer engagement to enhance the experience and improve retention.

In fact, you can easily measure the ROI of chatbots by conducting a survey, collecting feedback, and getting a sense of how happy and satisfied your customers are. All in all, we can say that customer engagement is crucial for every business. It is crucial in every domain that you visit and chatbot in banking is not far behind.

These are promising numbers and show great credibility in AI. It clearly illustrates how chatbots can improve customer experience in the banking sector.

There is, however, one condition that even tech experts recommend. If a bank wants to incorporate a chatbot, then they must try it out internally to understand how reliable and compatible the technology is with their services before deploying it.

Once banks make the decision then comes the time to decide how reliable it will be for the customers. Additionally, banks have to measure the ROI of building and managing a fully functional chatbot. While numerous companies are suggesting that chatbots have helped them save a substantial amount of money, in the end, what matters is how well the bot can manage and engage customers. The key here is not only to save money but to provide a seamless experience.

After all, the banking industry doesn’t need a half-baked self-help customer software. It will only lead to unresolved customer issues that will come back to a customer support executive. So what would be the point of having a chatbot, right?

Good that we are in an exciting time, witnessing all kinds of technological advancements. As a result, banks are also leveraging this fact and trying to integrate with chatbots to increase efficiency.

Many of them can be resolved with the right implementation and will bring better customer satisfaction. Hence, better business results with lower operational costs and better customer retention.

If you were wondering why I shared my bank statement misery right in the beginning, here’s why — Instead of sending out emails and SMSs for statements, upgrades, policy changes, etc., and leaving the customer bewildered rather than intrigued, banks can automate the entire process through personalized push notifications sent via chatbots. This can end with — “Want to know more?” — to which a customer can say — ‘Yes’ — and find everything there is to know, at one single place.

A simple, “Hey, your salary is in. Go have fun!” sounds way more pleasant, encouraging, and personal than, “Your account XXXX has been credited.” What more reasons do we need now?

2. Automated vs Live Chats: What will the Future of Customer Service Look Like?

4. Chatbot Vs. Intelligent Virtual Assistant — What’s the difference & Why Care?

Bank executives primarily have 2 jobs:

Do selling plans generate revenue for the bank? Yes. Does solving customer queries generate revenue for the bank? No.

Banking chatbots can take over the mundane, non-revenue-generating tasks and support multiple customers at the same time. Moreover, every time there is a change, chatbots need to be told only once, unlike training executives repeatedly to ensure that they deliver the right message.

Eg: Swedbank’s Nina takes care of service calls while the employees do the sales calls to add more value to the company.

As much as we hate to admit it, we have time but it’s never enough.

A new visitor must be saved the hassle of going through the bank’s entire website to find 1 piece of information. An executive doesn’t have to entertain queries when a chatbot can do it uninterruptedly without getting bored, seeking motivation, taking breaks, or demanding an appraisal.

On one hand, I was ravaging my hard-earned money, and on the other:

The bottom line is, chatbots automate tasks, whether simple or complex. What’s important is that enterprises develop bots using a platform that is capable of developing both. With a truly enterprise-grade chatbots development platform, the possibilities of what a bot can do are endless. Such platforms could turn out to be the real holy grail of customer service excellence for both customers and bankers. Global banks are embracing AI technology and are excited to make it a part of their digital strategy in the long run.

Banking chatbots are emerging as the preferred customer support platform. It is useful for financial service providers because they facilitate 2-way communication with machines using natural language commands. As per the latest data, close to 70% of customers prefer contextual conversations with chatbots. Since they can find answers to their questions much faster and the interactions are much more seamless, they would always pick bots over agents.

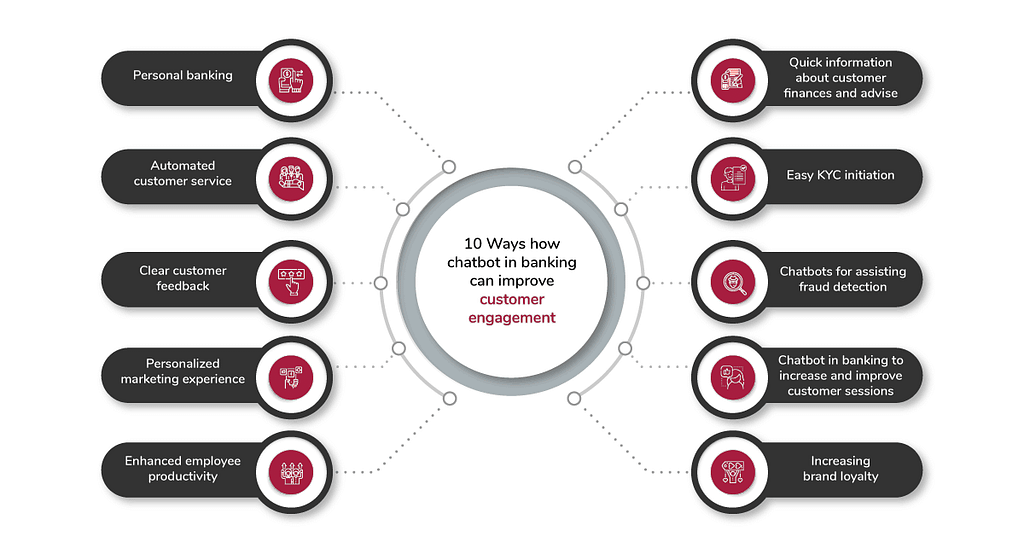

Here we discuss 10 ways in which chatbots can improve customer engagement in banking.

Delay in services and lack of personalization are 2 of the biggest problems that most of the customers face today from the bank. However, times and things have changed now. Banks are opting for chatbots to create a personalized banking experience. Banking bots are reducing the waiting time and other related paperwork. As a result, customers get faster and personalized services that save a great amount of time for both parties. The customers no longer have to visit the bank every time they need an account of their expenditure. Now chatbots can effectively provide the required account statements to the customers.

Banking Chatbots can also provide useful information that is related to the latest bank schemes, KYC, and resolve customer queries. The best part is that customers don’t have to wait for someone to attend to their queries. Chatbots are already trained to manage these queries and provide relevant support.

Banking bots are proving to be extremely helpful in providing seamless customer service. In fact, chatbots are also helpful in analyzing data, detecting fraud, and capturing data. Automation enables the chatbot to inform the user about every transaction to prevent any form of miscommunication or mismanagement. This helps in preventing any kind of fraud by identifying possible discrepancies right from the initial stage. Users are always on top of their account activities because they receive notifications simultaneously. The bots can assist the customers at any time as they are trained to grasp their queries and provide the best possible solution, simultaneously making them feel like they are interacting with a human.

The bots also aid the banks to address any customer complaints by analyzing the grievances of the customers and providing important insights. They also help the banks improve their services. It is also essential in improving product offerings.

Customer feedback is one of the most important elements of any banking service. Intranet-based chatbots help banks get more specific customer feedback. It can help them improve their services. The staff can gain information about the shortcomings and the management can offer helpful solutions. This further improves the experience and increases efficiency. This indicates that the situation is favorable for employees, management, and customers as they all are in a much better position at work.

Even though banks provide a plethora of services to their customers, not every service can have the correct taker for it. Thus to provide the customers with personalized services, banks can accomplish this particular goal by deploying chatbots. As a matter of fact, the delivery of personalized services can improve the overall rates of conversion by 25%.

Banking Chatbots have multiple benefits. These benefits don’t just revolve around customer experience but they mean to improve employee experience too. Chatbots help saves a lot of employee time, which they save from automated responses and assistance. With this, employees don’t get worn out by repetitive, monotonous tasks. As a result, their efficiency increases and they become more productive.

Some of these repetitive and monotonous activities include accessing personal details, maintaining a record of payroll details, applying for leaves, updating the contact information, performing a detailed review of time-sheets, and other tasks. Once chatbots automate these tasks, banking professionals have more time to concentrate on important deals. They will not get worked out and this way, their productivity will increase. As a result, they will be able to better serve customers and improve their experience.

From end customers of the bank to CXOs, customers of different banks come from a diverse range. Chatbots are proficient at providing all sorts of financial information and are also capable of keeping this information safe and secure. In fact, chatbots provide this information with much contextual context and insights for greater knowledge. With this, we now embrace conversational banking and view chatbots as new-age banking executives.

Banking bots can also advise customers on how to manage and invest their money. Professionals train them enough so that they are updated with the latest news, trends, and information. Chatbots can demystify complex banking and financial terminologies and help customers make smart financial decisions.

Customers no longer have to fill up the same kind of form every time they visit a bank. Banking Chatbots will enable simple and easy transactions with just a few clicks on finger impressions to ensure that these transactions are safe.

Whenever a customer signs up with a bank, they trust the bank with their hard-earned money. So, banks must ensure extra care to maintain this trust. Chatbots act as helping hands in sending you to push notifications proactively. These automated programmed notifications keep you updated about transactions done on your account in real-time. If it’s a fraud, you can also reply to the messages with pre-customized instructions to stop the transactions.

You may also get unsolicited marketing messages from chatbots. If you find it irritating, you can simply shut it out with ease without the fear of hurting anyone. A chatbot is not a human that carries a grievance or grouse. The good part is, the chatbot can do a good analysis of your customer sessions, read your likes and preferences, and proffer the right products and services. Chatbots can be useful to spread word of mouth to customers.

There’s a lot of pressure on banks to retain and grow their customer base while up-selling, cross-selling additional products and services. There’s a demand for convenience and innovation, but oftentimes when customers come face-to-face with this innovation, it feels like they’re interacting with an entirely new platform and instills a feeling of mistrust. So to put brand loyalty back into banking and to counter these issues, many institutes have adopted AI chatbots.

AI chatbots drive innovation in a controlled manner. They build brand loyalty by engaging with customers on the channels they prefer slowly finding a place in the customer’s daily life. It’s comparable to how modern customers interact with friends, family, and colleagues. Banking chatbots can also create personalized brand experiences that increase acquisition, conversion, retention, and loyalty.

These are just some of the basic ones that we currently target. There are many more that can be implemented to provide for an always-available intelligent interface for a customer to transact on to fulfill their banking needs. AI in banking can be extremely beneficial to reduce service volumes to more automated channels.

Banking and financial services deal with a lot of sensitive customer data, so security has to be a top priority when building a chatbot. You need to communicate how you’re protecting your customers and how you’re ensuring their privacy. Consider deploying an on-premise chatbot to avoid data breaches and enabling authentication systems when building your chatbot.

What if your AI chatbot can remind you about important bank payments? Periodically inform you about the state of your budget? Suggest how to save money? Inform you about financial products that are best fitted for you? Provide an investment portfolio update? Deliver important, time-sensitive notification?

This banking bot infographic designed by Engati will give you a quick view of how you can not only save your time but also provide you a better customer experience!

Another major BFSI company, Qatar Insurance Company (QIC), uses an Engati chatbot to increase customer engagement, drive sales, and create amazing customer experiences.

Check out their video testimonial

Erica, derived from the word America was introduced by the Bank of America. It is used to give information about the account balance, send various notifications to the customers, provide updates, share credit reports, suggestions, pay bills, and help customers in completing their transactions.

JPMorgan Chase uses chatbots to improve its back-office tasks. The chatbot can perform better than a human law executive for analyzing long-format legal documents and assist.

Wells Fargo uses Facebook messenger as well as AI chatbots to respond to user queries. It provides information like which is the nearest bank ATM and their account balance.

American Express focuses on the merchant relationship by making them aware of the benefits of a credit card, contextual recommendations, and notifications regarding the sales. To avail of the benefits, customers must connect to the AmEx messenger chatbot.

The revolution with chatbots in banking has been incredibly phenomenal. Banking chatbots are not just providing excellent customer service but are improving the way customers interact with banks. In fact, chatbots are revolutionizing the way banks provide their services to customers.

Banks put a great amount of value on customer support because it’s a huge driver of customer satisfaction. They need to rank ahead by providing great products and services, brand recognition, trust, cost, and innovation.

Additionally, chatbots for the banking industry are doing great in ensuring cost-saving for banks. It is estimated that problem resolution over the phone with live agents comes out to be anywhere between $5 and $35 per call. On the other hand, live web chat costs around $3 per interaction. Pretty cheap and efficient, isn’t it?

Chatbots that use human-to-machine interactions cost less than $0.50 per interaction and often deliver answers much faster than other engagement channels. Beyond being a less expensive engagement channel, chatbots also reduce — at a bare minimum of 10 percent — the number of support calls and chats a bank receives.

Therefore, there’s great promise for banking chatbots. In fact, banking officials want to collaborate more with AI specialists to ensure great service for their customers. After all, it is about faith and trust when it comes to your money. And banks want to improve how you manage and invest your money

Build your own contextual chatbot now!

10 amazing ways chatbots can improve customer engagement in banking was originally published in Chatbots Life on Medium, where people are continuing the conversation by highlighting and responding to this story.

The current market is like a sea. And if the customers are fish, the companies offering their products are fishermen. And since the number of fishermen grows constantly, they are looking for new ways to lure fish into their nets. And that’s where artificial intelligence joins the game. AI is not only a great tool to help companies to attract and keep new customers, but more importantly, it offers customers a new level of accessible, pleasant, and personalized service.

The release of a new product is often preceded by a marketing survey. Its task is to observe the target audience and its needs. Today, however, it rarely happens that a marketer stops you on the street and starts asking questions about which notebook or kind of soap you use. The process of data collecting has mostly moved to the telephone and internet world. And that is where AI virtual assistants like chatbots and voicebots are increasingly working.

Here are 5 reasons why entrusting your marketing survey into the hands of AI may not be a bad idea.

There are a couple of reasons why the use of virtual assistants in marketing research means more safety. The first one is most valid during present times affected by a coronavirus. AI makes completely contactless surveys easier for both sides. The other reason is that a virtual assistant is the most pleasant interviewer to share your information and opinions. Whatever you say will not make the conversation unpleasant or provoke a mocking reaction. As Tomáš Malovec, the director of Born Digital startup, which develops virtual assistants says:

“AI remains professional in all circumstances. And the information you provide is nothing but data to it,”

Artificial intelligence doesn’t mind doing the same activity over and over again every day, which is good news for business owners and human operators. Their AI colleagues handle the most routine calls and surveys instead of them and allow others to focus on more complex parts of their work. After the data is collected, a good virtual assistant can also create necessary marketing reports, which usually cost marketers a lot of their valuable time.

The essence of secondary marketing research is to work with data that is freely traceable. This is a mechanical and time-consuming activity. And that’s why companies often welcome the opportunity to entrust it to artificial intelligence. It can easily find its way around the enormous amount of data offered by the archives of the media and government institutions. AI then extracts only those data that are essential for marketing research. All for a fraction of the time and cost that secondary marketing research would otherwise cost.

2. Automated vs Live Chats: What will the Future of Customer Service Look Like?

4. Chatbot Vs. Intelligent Virtual Assistant — What’s the difference & Why Care?

A virtual assistant for marketing research is not a slow automaton with a monotone robotic voice. “Thanks to artificial intelligence, these assistants can have a fluent conversation with people, answer their open questions and move the survey forward. Besides, they have a pleasant voice and are constantly learning and improving,” Malovec described. AI can remember the hundreds of ways a conversation can take during a survey. And it can still learn new ones.

While new kinds of jobs appear across the industries, some current positions are replaced by machines. And it’s good news for customers that in the field of marketing research, those machines are more and more often equipped with artificial intelligence. “Thanks to their pleasant voice, professional approach, speed, and accuracy, virtual assistants are miles ahead of other technologies for digitizing communication, such as interactive voice response machines,” adds Malovec. They are also more consistent in routine tasks and sometimes even friendlier than their human colleagues because they do not mind asking the same questions all day or being rejected.

And while it may seem that the first four reasons have little or no impact on customer satisfaction, they all help to build the environment, in which the customers always receive complete and helpful service, which will make their life easier. And as research shows, the use of AI does not only help the companies, but it mainly improves the satisfaction of customers.

Conversational AI helps companies to know their customers better was originally published in Chatbots Life on Medium, where people are continuing the conversation by highlighting and responding to this story.

Hi! I’m writing my master thesis on the subject: “user experiences with chatbots: motivations and influence factors”, and I have made a survey in order to get more data on this topic. It will take about 10 minutes. If you have some time to help me out it would be much appreciated!

submitted by /u/ingoray

[link] [comments]

Hey Chatbots Community! 👋

After four years of development, we are happy to share Airy with you.

Airy is an Open Source Conversational Platform to store, structure and utilize conversational data in a secure and privacy-compliant way.

With Airy, you can integrate with Conversational AI like Rasa or DialogFlow to train smarter models based on actual conversations.

You can host your own open source messaging API to enable your developers to build conversational experiences even for privacy-sensitive industries, such as banking, insurance or healthcare. Airy’s core platform is fully open source and runs in your own cloud or even on premise.

We built Airy on Apache Kafka for ultimate scalability, so you can ingest and stream all kinds of conversational data to:

👉 unify your messaging channels

👉 include human agents via an Inbox UI

👉 gain insights from Conversational Analytics

Airy has connectors for conversational sources such as:

✅ Facebook Messenger & Instagram

✅ Google’s Business Messages

✅ WhatsApp Business API

✅ SMS (via Twilio)

✅ Airy Open Source Chat Plugin

✅ Custom sources

📺 Check out a short intro video of Airy here: https://youtu.be/zwDosYHitYg

🛠️ You can start trying it out by reading on our website: https://airy.co/clp

If you like what we are doing, please give us a star ⭐ on Github: https://github.com/airyhq/airy

And we are of course happy to answer your questions! 🤗

submitted by /u/SympathyCommercial38

[link] [comments]

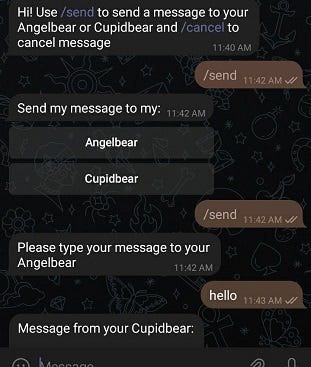

I was starting an hour long commute home when my phone came abuzz. A friend was organizing the annual Angel & Mortal game for our residential college community and was interested in leveraging some online platform for anonymous communication between players. The rules of Angel & Mortal are simple:

Typically, players would send messages to the organizers to be manually forwarded to their Mortal or Angel, asking for their likes/dislikes or informing them of new gifts. I immediately found this project to be simple yet impactful and was compelled to help. Unfortunately the game was starting soon, in a week, so I had to work fast.

This bot was developed in Python using the python-telegram-bot package. This allows you to run a simple server that will poll for messages sent to your bot on telegram. Before starting, you will need to set up a bot using the BotFather and generate a token (instructions here). The initial player data are loaded from CSV.

Original code used when I was running the bot (sorry if it’s messy!) can be found here: https://github.com/kstonekuan/angel-mortal-bot

Before diving into the chatbot logic, it’s important to understand the theory of the game itself. Each player has an Angel and a Mortal. Furthermore, your Angel is another player in the game who has you as their Mortal and vice versa for your Mortal. From an OOP perspective, each player can be represented as an object that references other player objects. Along with some telegram attributes, this can be represented by a Player class.

2. Automated vs Live Chats: What will the Future of Customer Service Look Like?

4. Chatbot Vs. Intelligent Virtual Assistant — What’s the difference & Why Care?

While not crucial, you might recognise this as a graph node from graph theory. In particular, the game is designed as a directed graph. Each node has two outgoing edges (to the Angel and Mortal) and two incoming edges (from the Angel and Mortal).

While it might be possible to use our system to generate Angel-Mortal mappings, organizers often have a more in-depth understanding of social dynamics within the group. I chose to load provided mappings from a CSV file, as opposed to using something more complex (but efficient at scale), as it was simpler for organizers to modify the data. After loading, players can be stored in a dictionary or hash map in memory, similar to an adjacency list

Note: I reference parts of the python-telegram-bot API without explaining them, please refer to their tutorials for this.

You might have noticed that our Player class includes a username and chat_id. The username is used to identify players and is provided by the organizers while chat_id is what is used to send messages. We cannot send messages directly to a username as it would be unclear how we want the bot to communicate such as in a private message or group chat. Each user needs to start a chat with the bot first in order to get the chat_id that is generated by Telegram. I also went one step further to reject users that do not appear as a key in the dictionary as they are not registered players in the game.

Conversation handlers can be used to create simple menus to guide users through your bot flow. For this bot the user must first choose either their Angel or Mortal before sending their messages across. They may cancel the conversation at any time to switch between the two. Thanks to the class created in previous steps, it is not difficult to find the reference to their Mortal or Angel and get their respective chat_id to forward messages.

The result should look something like this (with custom names for Angel and Mortal):

So far you might have been testing your bot locally but it is probably not a good idea to keep to run this on your own machine for the entire duration of such events. I personally made use of Microsoft Azure free student credits to host but there are many options available.

As this was built in a few days with little time for testing there are many improvements you may want to make.

I really enjoyed building this bot and helping out my community. This is my first article about programming so I hope you enjoyed reading and am always open to feedback about my writing!

Building a chatbot for Angel & Mortal was originally published in Chatbots Life on Medium, where people are continuing the conversation by highlighting and responding to this story.

Who would have thought a simple tech can integrate your business across platforms like Facebook Messenger, Google Assistant, Website, Telephone, Telegram, SMS, etc. Chatbots have made this possible. Chatbots have been a growing trend for the last few years. Many of us have interacted with a chatbot at some point. As chatbots are getting smarter day by day, it is becoming useful to various industries. Whether you want a chatbot to respond to “life advice” questions in light of the new year or want spiritual guidance for peace of mind or want to book an appointment with the doctor, the chatbot will always grab your attention.

One successful restaurant chain businessman from New York has made a startling statement in its annual report. “We believe the development of artificial intelligence and machine learning, combined with other disruptive technologies like a chatbot, will reshape the food industry landscape in the coming years.”

The statement was very crisp and many other players were echoing that statement. So what is it in chatbot which makes it such desirable tech? And is chatbot really the future for small-scale Restaurant/Food outlets? Let us discuss that.

Automation is not an alien for the food industry. In fact, the Food industry has been leveraging automation for many years in terms of scaling production through robots or setting up vending machines or restaurant reservations.

Websites and smartphone applications have gained the bulk of the share of online food ordering systems over the last decade. The not so enjoyable part of ordering food using a website food ordering portal or using the mobile app is, customers have to follow the language of the food ordering portal/mobile portal. Another most annoying part of ordering food through mobile apps is, customers have to carry different apps of respective restaurants/outlets to order food, whereas chatbot lets customers order food in their conventional language just as you order food from a waiter in a restaurant. Also, customers are not required to install so many apps. Chatbot being capable of integrating on different chat channels like Facebook Messenger, Website, Google Assistant, Telegram, SMS, Telephone will allow customers to order food from their preferred chat channels.

We’re seeing chatbots being able to provide a whole variety of assistance. Not only can customers order yummy foods like pizzas, sushi, noodle soup, tacos, salads, and hamburgers all within two minutes but customers can make the reservation or get answers to FAQs. Let’s take the example of Pk Foods.

You can try the website demo here: PK Food Chatbot

PK Foods is a Dialogflow based Food ordering chatbot for restaurants and food outlets. PK Foods helps customers to browse the menu and allows them to place an order of their favorite food. Customers can add or remove items while placing an order. PK foods chatbot can be integrated with Facebook Messenger, Website, Google Assistant, Telegram which help business owners to be present across the platforms. In the coming days, we are also planning to integrate this chatbot with more chat channels like SMS, Telephone, Alexa.

With PK Foods Chatbot customers can choose two delivery options: 1. Home Delivery 2. Store Pickup. Considering this pandemic situation, both these two options become very useful and imperative.

After the customer places an order, PK Foods chatbot sends the order summary to both customer and the Kitchen department via email. In the coming days, we are also planning to integrate a few payment gateways where customers can pay via chatbot itself.

2. Automated vs Live Chats: What will the Future of Customer Service Look Like?

4. Chatbot Vs. Intelligent Virtual Assistant — What’s the difference & Why Care?

What makes chatbot so desirable

Chatbot is nothing but an AI-based computer program that simulates human conversations. Chatbots are also known as virtual assistants which have the capability of understanding conventional human language. Chatbot interprets and processes the user requests and gives prompt relevant answers.

As each day passes, machines are becoming smarter and customers are increasingly getting more reliant on them. And it is quite spectacular to see more and more people are embracing voice technology like google assistants, Siri and Alexa nowadays. This forces many business owners to make their business available on such platforms. And when you think from a consumer’s perspective, don’t you think it would be great if a customer can order dinner while heading back home in a car rather than going into a restaurant and asking for an order and waiting till your food gets packed? This seems a small thing in a way but it greatly impacts the customer’s experience. There are many more benefits of having a food ordering chatbot like saving human resources, eliminating human error, streamlining the process, and so on.

Chatbots are also increasingly becoming a great marketing tool. Just like Subway, which has introduced its food ordering chatbot, where customers can order sub using Facebook messenger. Subway’s chatbot also allows customers to choose the ingredients. Those tempting images used in chatbots definitely can provoke anyone’s taste buds. Subway can run the Facebook ad either for special festival discounts or for new product launches and users can order the food from the Facebook messenger itself.

Chatbot has the unique capability of engaging the customer, which is a great help not only to the marketing team but it is beneficial to so many aspects of the business, be it in delivering service to customers in a polite manner during a bottleneck situation or gathering feedback regarding food quality, etc. A large number of local players in the food industry are also integrating the chatbot in their existing food ordering system and they are getting benefits in terms of streamlining the activities and reducing the cost. The operating cost of a food ordering chatbot is very minimal. For certain platforms like Facebook messenger and website operating cost is as minimal as zero.

Seeing the trends, Chatbots are going to play a key role in automating the number of repetitive tasks in the coming years. The chatbot offers so many benefits to the company, it is a time when companies should leverage technology.

Is Chatbot really the future for small-scale Restaurant/Food outlets? was originally published in Chatbots Life on Medium, where people are continuing the conversation by highlighting and responding to this story.

When customers reach out to the company for service, they expect instant responses to their problems. However, a customer care provider can only cater to a certain number of cases at a time.

How do you scale support? Have you thought about the customers?

There are so many service horror sagas that customers have experienced like long wait lines where the agent is unavailable, one where the agent is unable to deliver answers to customer’s questions, agents ghosting on a customer on call, and inconsistent answers provided by service agents.

If only there could be one place where the customers can go to, where there is an instant answer to their queries, quicker issue resolution and minimum agent transfers?

Botspice- AI-Powered Customer support chatbots

Customer care bot by Botspice, an AI-powered chat interface that answers customer FAQs and dynamically resolves customer concerns via smart interactive conversations. Breakthroughs in technology have completely changed the way businesses communicate with their customers. Organizations are under tremendous pressure to drive customer interactions effectively and respond to their query in minimal time. Gartner reports that virtual assistant usage in the workplace will climb to 25 percent by the end of 2021. To meet business goals and generate more revenues, companies must implement a system that engages customers more effectively.

According to the definition from Chatbots Magazine,

“A chatbot is a service, powered by rules and sometimes artificial intelligence, that you interact with via a chat interface.”

Chatbots are also often compared with apps, as Gartner highlights it in its definition.

Why AI-powered bots? Do businesses need it?

Merely engaging customers through chatbots powered by rules is not enough, engaging them through smart interactive conversations, using machine learning & NLP and continually getting better at answering those questions in the future is an essential attribute of a chatbot. Like all successful automation efforts, customer service chatbots can reduce costs, but the improvements they make in customer experience are far more impactful. Bots are available 24 hours a day, 7 days a week, and often, customers’ questions are answered more quickly than human agents.

Do businesses need Workbots?

Well, the main goal of a customer service chatbot is to help businesses optimize resources and reduce agent turnover. How can a business achieve this goal? By providing exceptional customer service across a customer’s journey and also add value in the post-sales journey. Workbot is your best bet when it comes to creating engaging and interactive conversations. Workbot increases user engagement by using interactive workflows and making the conversation more human-centric.

2. Automated vs Live Chats: What will the Future of Customer Service Look Like?

4. Chatbot Vs. Intelligent Virtual Assistant — What’s the difference & Why Care?

What are the benefits and outcomes of implementing the Workbot for customer service?

Technology shift expects businesses to take ownership of the customer engagement process. Optimizing the customer experience and implementing real-time and consistent interactions is the way forward. Workbot does just that by creating a positive and memorable experience at various customer journey touchpoints.

By automating customer service using AI-powered bots, companies can

A successful customer service chatbot will minimize the number of agents needed at a given period and provide consistent service with increased productivity. Often customers hesitate to call the customer service agents simply because they have to repeat themselves over and over again. By using friendly and approachable AI-powered chatbots, businesses can ensure that customers can have their queries understood and addressed via a simple text request.

57% of customers would instead contact companies via digital media than use voice-based customer support, as per Ameyo’s research.

Forrester says, nearly 1/3 of customers send a mobile/SMS message to the company requesting assistance.

Perhaps the biggest reason why so many companies collect consumer data is that it helps them to get a much better understanding of the way their consumers behave online, define their overall demographics, and identify how they can improve the overall customer experience. You may have heard the phrase “Content is King” first coined by Bill Gates following his essay of the same name in 1996.

Susan Bidel from Forrester says, ‘In the Age of the Customer, Data Is King’

It is therefore crucial to be able to access information about customer’s choices, demographics through conversational funnels. Precise user data and metrics allow organizations to optimize marketing plans. Knowing what does and doesn’t work allows organizations to be far more agile, responsive and targeted in their marketing and customer outreach efforts. AI chatbots can analyse millions of customer data touchpoints in real-time and help organizations access customer information at any point in time.

Organizations can analyse the statistical data and record market behaviour over time to generate valuable insights for strategizing and forecasting future business plans. Through analytics, dashboard organizations will be able to drill down and measure how effective the marketing strategies were in converting a potential lead to sales. Analytics dashboard can also predict what isn’t working in a customer journey. For example, if a customer drops off mid-way from a chatbot conversation, the organization can determine what exactly is not creating engagement which, in turn, can create new growth opportunities.

AI-powered chatbots communicate via a two-way conversational channel. It allows users to ask what they want without limiting themselves to a pre-determined set of questions. Workbots are available 24/7 and can help keep a business stay connected to its customers and provide consistently high support quality even when the support agent might not be available. Implementing Workbots can help build the customer’s trust, create loyalty and increase CLV customer lifetime value.

Workbots can be programmed to track your customer’s behaviours and choices based on their purchase decisions and the questions they ask. This can help organizations to generate up-sell opportunities and entice customers, thus driving revenue increase.

E-commerce statistics show that businesses spend around $1.3 trillion on customer requests every year.

With Workbots customer service costs can be reduced to a significant amount. It can be exceptionally expensive to keep up and scale support with ever increasing customer service demands. This is especially so when one thinks of the manpower involved. Recruiting, training and retraining agents can be expensive especially as the organization grows. Artificial Intelligence-powered chatbots will be a smart solution for development and integration. Once deployed, it can help a business scale up service and sales interactions across multiple channels and enrich customer journey touchpoints.

All these are just statistical benefits but the one benefit that organizations look for is increasing revenue-per-case while reducing cost-per-case That is what differentiates a mediocre chatbot from an AI-powered Workbot.

Botspice delivers a vertical Artificial Intelligence that owns the entire workflow to solve targeted customer needs. It develops a complete product from end-to-end, starting with understanding the business case to optimizing product performance.

Every brand needs an expert interactive agent!

How does this work? How can I implement Workbots?

How does a Workbot work? Workbot uses Natural Language Processing to analyse the user’s request to understand the intent and extract relevant information. It then responds to the user with an appropriate answer which could be either:

Botspice simplifies the design, development and deployment of bots across multiple channels like messaging apps, digital assistants, collaboration tools and enterprise applications. It allows organizations to customize Workbots with rich media and a dynamic conversational flow. AI-based knowledge “Brains” enable Workbots to respond to queries 24/7 with consistency. Once ready, your AI chatbot is ready to be published.

Workbots improve over time. The number of intents they can recognize will expand as your company identifies which questions are of high volume handled by the chatbot.

In conclusion

A successful virtual assistant will reduce cost and scale support especially if you’ve set it up with the right intention and deployed them to the right channels to optimize success. AI-powered chatbots are crucial to a well-designed customer service strategy. Workbots can help either strengthen or substitute the need for two-way human intervention thus cutting total operational costs and improving customer satisfaction. When implemented correctly, Workbots can enhance the user experience, improve engagement and provide customers with actionable solutions. How will you implement chatbots into your customer service strategy from now on?

AI-powered chatbots to scale customer service support. was originally published in Chatbots Life on Medium, where people are continuing the conversation by highlighting and responding to this story.