|

submitted by /u/mihircontra20 [link] [comments] |

Author: Franz Malten Buemann

-

Top 6 Use Cases of Chatbots in Healthcare

-

Customer Experience Survey on use of Chatbot on Social Media: Case Study of WHO chatbot on WhatsApp

Please take a few minutes to fill this questionnaire. Anyone who’s used chatbot in the last six months can fill especially those who have used it on Whatsapp. This is part of my college research. If you have any feedback that is welcome too. Thank you!

https://docs.google.com/forms/d/e/1FAIpQLSfQ7D6mR1eF1E6589ktdhQrkgqtUuRxzFkJFm8wfJEwA1twcg/viewform

submitted by /u/Hiitsmehak

[link] [comments] -

Chatbot course suggestion

Hi guys, I want to learn chatbots specialising in e commerce using manychat and dialogflow. Can somebody suggest me a good course with good reviews?

submitted by /u/Relevant_Painting_93

[link] [comments] -

AI enabled chatbots to create stellar automated customer support experiences

Chatbots are on the rise and here to help make lives of people and businesses easier. Especially in customer support, chatbots are often used to help answer customer inquiries. However, chatbots are not always as good as we hope them to be. Frustrating and rigid question/answer flows ruin the customer experience and are hurting your brand reputation. Setting up a chatbot can also become very expensive and time consuming.

This article helps you to understand the different chatbot degrees for customer support and what pitfalls to be aware of when implementing a chatbot in your customer support.

What chatbot degrees are there for customer support?

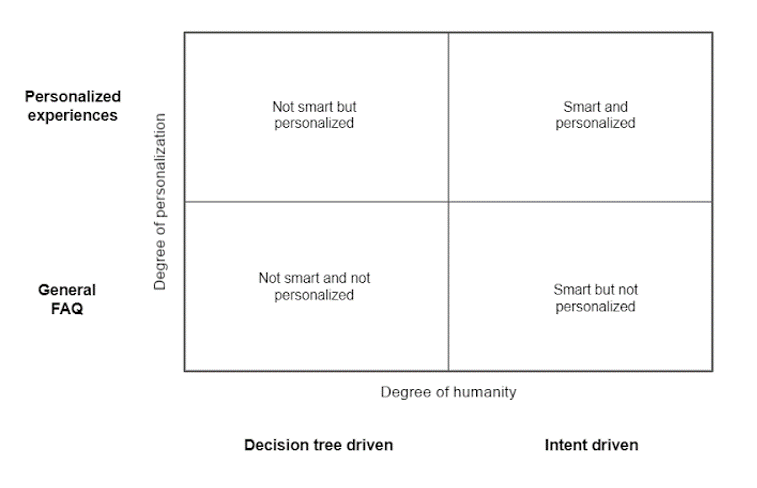

When looking at chatbot and customer support automation, there are two axes you have to look at.

The first axis is the degree of humanity in the conversation. On the far left you have chatbots that are very much decision tree driven with simple questions and answers. On the far right you have chatbots that understand human language by using Artificial Intelligence (AI) and Natural Language Processing (NLP) technology. These chatbots are intent driven.

The second axis to look at is the degree of which personalization takes place. On the far left you have very general, FAQ based questions. On the far right you have personalized experiences like changing an order and cancelling a subscription.

What pitfalls are there when implementing a chatbot in your customer support?

Implementing a chatbot can be tricky, depending on the degree of personalization and the degree of humanity you want in your customer conversations. Here are the 3 biggest pitfalls when implementing automation in your customer support.

Using a DIY chatbot builder

The first pitfall is to use a DIY chatbot builder. Yes, it’s easy and quick, but you’re only building a simple chatbot that is not smart and not personalized

This ruins your customer support experiences and hurts your brand name.

Building a chatbot from scratch

Beginning from scratch for a chatbot can create good, human-like and personalized customer support experiences, but is also very expensive. Unless you are a big company that can spend 100K a year on chatbots, this is a no-go for small businesses.

Trending Bot Articles:

2. Automated vs Live Chats: What will the Future of Customer Service Look Like?

4. Chatbot Vs. Intelligent Virtual Assistant — What’s the difference & Why Care?

Training the NLP engine yourself

To make human-like automation experiences with a chatbot, you have to train the NLP so it understands human language. This is a time consuming process where the NLP engine needs continuous corrections and learning.

Here again the rule is that unless you’re a big company with dedicated Conversational AI experts, this is a no-go for small businesses.

At Table Duck we create smart and personalized customer support experiences for small businesses without you having to train the NLP, build a chatbot from scratch or use a DIY chatbot builder that just isn’t creating that experience for you.

We have predefined sets of intents with all the training data required to create a good experience. Our platform is an easy to use, non-time consuming way to automate your customer support.

Looking for customer support automation software? Go check out tableduck.com

Don’t forget to give us your 👏 !

AI enabled chatbots to create stellar automated customer support experiences was originally published in Chatbots Life on Medium, where people are continuing the conversation by highlighting and responding to this story.

-

Why You Should Invest in Real-time Consumer Communications

Real-time communications have become one of the cornerstones of digital customer experience. Whether it is a pizza delivery or an amazon order, customers expect real-time updates on the status of their orders at all times. It is no longer a “competitive edge” or a “unique feature”, rather the basic minimum requirement to succeed in a demand-driven environment.

While this trend is currently limited to hyper local delivery services, industry giants including Amazon, is expected to take it to the next level in the years to come. Increasing popularity of online shopping, powered by Shopify and similar platforms, will further accelerate this shift in customer service. Though the trend may only be gathering momentum now, it was established way back in 2017 that “Gen Z is more than twice as likely to drop a brand for poor features or responsiveness on social media, according to the survey.”

COVID-19 may just have pushed us 10 years ahead in this direction. Challenges posed by the pandemic, especially in terms of supply chain management and mobility restrictions, have presented brands with an opportunity to create and maintain communication channels with customers like never before. The need for trust, transparency and real-time customer service is at an all time high and those who act first will come out on top.

However, employing a call center for 24*7 customers is neither practical or profitable, especially for small- and medium- enterprises. This is where live chat bots come in. By leveraging natural language processing, chat bots can answer simple queries within seconds, enhancing customer relations and adding value to the brand experience.

Here are five reasons why you should have one:

- Over 60 percent of millennials use chatbots.

- Given the choice, customers prefer chats or texts over calls.

- Chatbots provide quick response for urgent queries.

- They make online reservations and orders easier.

- Chatbots can provide deep insight into consumer behaviors and patterns.

Trending Bot Articles:

2. Automated vs Live Chats: What will the Future of Customer Service Look Like?

4. Chatbot Vs. Intelligent Virtual Assistant — What’s the difference & Why Care?

No matter what stage of growth you’re at, driving customer centricity across all aspects of business is critical for consumer-facing businesses. A live chat support system can help you improve and optimize your customer experience through actionable insights and data.

Don’t forget to give us your 👏 !

Why You Should Invest in Real-time Consumer Communications was originally published in Chatbots Life on Medium, where people are continuing the conversation by highlighting and responding to this story.

-

The Evolution of Customer Service: Conversational Automation is Your Key to Success

The ways customers interact with businesses have drastically changed in previous years.

From the early days of face-to-face interactions, phone calls and contact centres, the customer service experience has evolved exponentially.

Shifts in consumer behaviour and advancements in technology are both catalysts for change.

The traditional methods of customer service are expensive to maintain and no longer meet the demands of modern consumers.

Leading businesses are now implementing more automated and cost effective solutions to provide superior customer service experiences. Only the organisations that are willing to adapt to changes in business-consumer dynamics will meet customer expectations and thrive.

We look at the way customer service has evolved and what businesses must do to succeed.

→ Augment Humans with Digital Employees: Using AI to improve CX, reduce costs, and maximise revenue. Click here to download the report.

Customer Service in the Past — Is This Still You?

The words “customer service” will provoke some rather underwhelming memories for most.

From waiting in queues in physical stores, only for them to shut as they approached the front-desk; to spending hours on hold, repeatedly hearing some rendition of “your call is important to us, please hold”; or speaking to countless customer service reps in the hope that one of them would be sufficiently trained to solve their query.

It wasn’t quality, it wasn’t enjoyable, it was anything but ‘service’.

If you needed assistance, often the only way of contacting a business was to visit a physical store. Businesses were only open on set days for a limited time. If you couldn’t make it to the store during that window, your enquiry went unresolved. It was one-dimensional and change was needed.

“You are in a priority queue”

Call centres would often place callers in an imaginary ‘priority queue’. The long wait times didn’t make customers feel like much of a priority though.

Then call centres emerged — the first evolution in remote-based customer service. Customers could simply pick up the phone and dial in. The trouble — everyone started doing it. Customers could spend half their day on hold, often hanging up without their issue solved. Sound familiar? So much for the priority queue.

Trending Bot Articles:

2. Automated vs Live Chats: What will the Future of Customer Service Look Like?

4. Chatbot Vs. Intelligent Virtual Assistant — What’s the difference & Why Care?

Soon enough, along came email, courtesy of the internet boom. Customers had more choice than ever before. Rather than wait for someone to answer their call, customers messaged the business directly at a time that suited them. Progress! The downside — similarly with call centres, businesses continued to respond to customers when it suited them. The more channels that relied on a human response, the longer customer wait and resolution times grew.

Customers weren’t the only ones fighting this battle. With more enquiries coming through multiple channels, businesses struggled to manage exploding volumes and only manual processes to lean on. Their solution — they’d hire customer service rep after customer service rep, filling contact centres to the brim.

Customer service occurred when it was convenient for the business — and many organisations still adopt this philosophy today.

They still have all the control. They respond when time suits them, regardless of how important or urgent the enquiry is to the consumer. These businesses are still facing the same challenges as before — enquiry volumes are through the roof, and resolution times remain dangerously high. This leads to a high cost-to-serve, dissatisfied customers, and customer loyalty that’s burnt beyond repair.

The Promised Land of Customer Service

In today’s highly connected and personalised world, customers want to engage with businesses on their terms — when and where it suits them. They want their issues solved immediately, with as little effort as possible.

To meet these ever-growing expectations, businesses are investing in automated customer service to handle customer queries 24/7 and reduce their cost to serve.

The importance of immediate customer service through an ‘always on’ model is highlighted by increasing demand for self-service. 70% of customers expect a company’s website to include a self-service application. Customers’ enquiries don’t only occur between Monday to Friday, nor do they only occur between 9am to 5pm. Finding a solution shouldn’t be restrained by a business’s traditional operating hours.

No longer is a fast turnaround a value-add for business, it’s a customer expectation. If customers fail to get a response in the first few minutes they are likely to move onto a competitor. This poses business risk for both customer acquisition and retention.

Some businesses have pivoted to knowledge bases and FAQ pages in an attempt to provide self-service options and deflect customer enquiries from their contact centres.

The challenge with this — the way customers consume information has also changed.

Just like they’ve moved on from waiting in queues or on-hold, customers no longer want to search through paragraphs of text to find answers. Attention spans are short and consumers demand more engaging experiences.

The introduction of messaging and conversational automation via Digital Employees (also known as AI chatbots) mean there are more cost effective and scalable ways for businesses to engage and serve their customers to the standards they demand.

Digital Employees handle customer interactions quickly and far more efficiently than traditional means. By automating conversations at scale they streamline customer service processes, easily solving high volume repetitive enquiries that take up so much of a human reps time.

The reduced workload on customer service agents enables them to focus on upselling and handling more complex issues, adding more value to your business and improving operational efficiency. Not to mention delivering a superior customer experience.

Digital engagement continues to rise and businesses must scale their customer service operations. Adding more agents is an expensive and short-term option. Using automation to deflect enquiries controls cost as the business scales, providing an engaging experience that is at the forefront of modern consumer behaviour.

Studies show that real-time interactions via conversational automation improve customer engagement rates by 50% and increase sales by 67%. The popularity of e-commerce has made everything available online to customers, leading to many businesses adopting Digital Employee chatbots as a new sales channel in combination with a customer service offering.

By sensing customer intent and offering personalised product recommendations, Digital Employees provide automated, guided selling experiences that bring in additional revenue with unrivaled ROI.

It’s important to note that the current approach to customer service via automated channels, is not replacing human interaction. It’s augmenting humans with Digital Employees to create superior integrated experiences for both customers and businesses.

While Digital Employees provide the first line of support, if they are unable to provide a solution, they can prompt a human agent to step in. A seamless handover, in real-time, with the exact context of the conversation is shared, allowing human reps to continue exactly where the Digital Employee left off. This provides an interactive, friendly, and highly responsive experience, far beyond the traditional bouncing around between agents in contact centres.

The modern approach to customer service through conversational automation and its benefits are easy to see:

- Faster responses

- Reduced wait and resolution times

- Cheaper cost-to-serve

- Improved customer satisfaction and loyalty

- Automation for scale

- Human when it counts

This all leads to more efficient business processes, greater customer experiences and a resulting increase in revenue for the business.

Failure to Evolve Risks Your Business

Businesses that choose not to optimise their customer experience now will struggle to provide the level of service that modern consumers demand.

A millimetre today is a metre tomorrow. The longer the delay, the further away you’ll be from where your customers want you to be.

Consumers instinctively gravitate to brands that exceed their needs and expectations. Frustrations with businesses that neglect these will catapult technologically savvy brands forward even further.

Much of this technology is over it’s hype and innovation stages. It has become more reliable thanks to advancements in AI and machine learning; just as messaging has become a normalised and mainstream form of communication — thanks to Facebook Messenger, WhatsApp, WeChat and various others. Just take a look at the numbers — more than 75% of people prefer texting over making phone calls. Companies that delay or fail to push forward customer service automation with always on, real-time conversations will struggle with growth.

Digital Employees also capture a wealth of customer and trend data. These insights are a treasure trove to marketing and sales teams. Smart businesses use this data to see what topics are trending and where friction points occur to understand and connect with their customers more intimately. All this data and information fuels the creation of customised marketing efforts to provide highly relevant, and more personalised customer experiences.

The progression of consumer behaviour, combined with advancements in technology paves a clear road ahead for even higher expectations in the future. Prioritising to stay ahead of the curve in customer service will make all the difference for the future of your business.

If you’re looking at where to from here, make sure you engage an expert. We’re happy to share how we help leading brands automate customer service at scale to reduce costs, increase sales and boost profitability. Start a conversation with us here.

Don’t forget to give us your 👏 !

The Evolution of Customer Service: Conversational Automation is Your Key to Success was originally published in Chatbots Life on Medium, where people are continuing the conversation by highlighting and responding to this story.

-

20 [M4A]. Making a Snapchat group for everyone

No Solo Guys tho. Solo guy need a female to come inside. Add me on snap: A.64448

submitted by /u/idontevenknow068

[link] [comments] -

Chatbot positioning

How can I change my PowerApps chatbot’s position on WordPress theme editor? I’d like it to be on the bottom right corner and to be locked in place as sort of a navigation bar. I am still new and don’t really know how to. Thanks!

submitted by /u/Wonderful-Abrocoma12

[link] [comments] -

How Teachers Can Use Chatbots to Analyze a Student’s Learning Skills

Artificial intelligence is getting a little smarter every day. Digital learning continues its expansion at all levels of education. Bots are designed to make our lives easier, more informative, and more interesting. Their machine learning capabilities make them a promising technology in education. The knowledge base of chatbots will only grow, and the bots themselves will be able to learn along with students.

With the abundance of existing online services in the e-learning segment, chatbots can guide each student individually, according to their level and chosen pace of learning. It makes learning accessible to almost anyone with access to Wi-Fi. Compared to traditional learning, chatbots do not require significant resource costs, and can potentially help millions of students around the world.

Robots won’t be able to replace humans in the classroom anytime soon, but they can already take over some of their workloads. Subject tests and essays take up a significant amount of teacher time to review. This is especially evident in massive open online courses, where there are hundreds and thousands of students, which makes individual feedback almost inaccessible. “Chatbots are the perfect solution to this problem” admits Luis Grillo, Head of Communications at Essay Tigers.

The prospects for using chatbots at all levels of education are almost limitless. Interaction with messengers already dominates modern students over communication in social networks, and it’s only a matter of time before they will study under the guidance of bots in WhatsApp or receive detailed feedback on completed coursework via Telegram.

Some universities are already experimenting with chatbots in their virtual lecture halls. Georgia Institute of Technology has successfully introduced a chatbot named Jill Watson as a lecturer. Jill, named after the famous IBM Watson, helped more than 300 students in the artificial intelligence Ph.D. program while testing the system. After a successful debut, Jill Watson helps students at various campuses around the world.

Chatbots are not only changing the field of learning but other areas as well. Nevertheless, the greatest success they have achieved in learning. For example, chatbots for language training are in high demand because students can learn languages at any time and they don’t need teachers.

Trending Bot Articles:

2. Automated vs Live Chats: What will the Future of Customer Service Look Like?

4. Chatbot Vs. Intelligent Virtual Assistant — What’s the difference & Why Care?

Chatbots for language training

One of the fields of education where chatbots may soon occupy a serious niche is language learning. Many foreign universities are now actively using chatbots that answer students’ questions and help take the load off teachers and engage students in their studies.

In the popular Duolingo app, anyone can chat with a robot: as you know, language learns faster through conversation. The creators have developed several characters for “live” conversations in a foreign language so that students can practice their vocabulary and check the correctness of grammatical structures. For more interesting conversations, the company has tried to give robots individual features. For example, students can chat with Chief Robert, Driver Renee, and Officer Ada, who differently answer questions and correct grammatical errors.

Compared to traditional language-learning software, chatbots are much more flexible and adaptable. They react differently depending on the response the user gives, considering different options as in real conversations. They can answer questions in different ways, and even “make the first move” if the student is stumped in the conversation.

In 2017, the Edwin bot came to light, with which anyone can chat on Facebook and learn new words. At the beginning of the conversation, the bot prompts you to choose a level, topic, and language of communication. The creators of the service hope that artificial intelligence technology will help users to fill up their vocabulary, and teachers’ time will be free for more complex tasks.

TeflBot is a robot that sends funny illustrations of quite popular English-language idioms every day. Thanks to the game form of presentation, it is ideal for anyone who wants to enrich their vocabulary.

japandictbot helps when the student needs to find at least a few common themes in a conversation with a Japanese person (it will translate any word or phrase), and will also be useful for anyone studying Japanese: the bot provides not only translation with transcription but also spelling in hieroglyphs. The Japanese who tested this bot agree that it has nothing to complain about: the program works just like a real Japanese teacher, the only difference being that it won’t scold you for a misspelled character or inappropriately pronounced word.

So, how chatbots can be used for student`s learning skills analysis?

Chatbot usage for student’s learning skills analysis

- Choice of one correct answer

Mechanics: the teacher selects one right option. The student is given one question and several options. He or she can choose only one option. Chatbot immediately answers right or wrong. Students can not change the choice of the answer.

- Choice of two or more correct answers

Mechanics: the teacher selects two or more right options. The student is given a single question with a lot of options and he or she can choose several of them. The chatbot immediately answers right or wrong. Students can not change the choice of the answer.

- Arranging answers in ascending or descending order

Mechanics: the student is prompted to arrange the answers in a certain order by clicking on/sending a message with a number. At the bottom of the message is shown the order in which the student pressed the buttons. If the order is correct, the student gets a certain score. It is impossible to change the answer choice.

- Choice of one correct photo

Mechanics: students can move photos forward and backward, pressing the select button and marking the selected option. The chatbot determines whether the choice is correct and accrues points.

Conclusion

Chatbots are in the early stages of development and still require substantial human support. However, the prospects for their use at all levels of education are virtually limitless. It is only a matter of time before students will study under the guidance of tutor bots in WhatsApp or receive detailed feedback on completed coursework via Telegram.

Don’t forget to give us your 👏 !

How Teachers Can Use Chatbots to Analyze a Student’s Learning Skills was originally published in Chatbots Life on Medium, where people are continuing the conversation by highlighting and responding to this story.

-

Explore ProductHunt Data on Chatbots with a Chatbot!

Hey Chatbot community,

I’m a big fan of Natural Language interfaces and see a great potential in them to simplify tools. I’m mostly focused on its usage for data analysis. Since there are many entrepreneurs here, I thought it would be interesting to share access to a dataset that I have put in place recently about ProductHunt posts, so the community can find new products using chatbot interfaces and explore how the trends are developing.

Well, Veezoo is itself a chatbot, so you can ask questions such as:

how many chatbot posts per month

top 10 chatbot posts this year

average votes for chatbot posts

PS: If you found it interesting, we just launched Veezoo on ProductHunt, show some love to a fellow chatbot and give us some upvotes maybe?

submitted by /u/jpmfribeiro

[link] [comments]