Your cart is currently empty!

Conversational AI Chatbot Use Cases in Banking and Financial Services

Insurance, and Financial companies like Wells Fargo, Citigroup, Bank of America, JPMorgan Chase & Co., American Express, and Fidelity Investments own the largest call centers in the US and witht over 3.3 million call center workers nationwide. However, we’ve seen a shift in how enterprises are investing in technology to reduce customer support costs and automate the bulk of customer requests. According to Juniper Research these operational cost savings will reach $7.3 billion globally with the help of Conversational AI in banking by 2023.

In this article, we’ve looked at the Top Conversational AI Chatbot Use Cases in Banking and Financial Services industries as well as the benefits of these implementations.

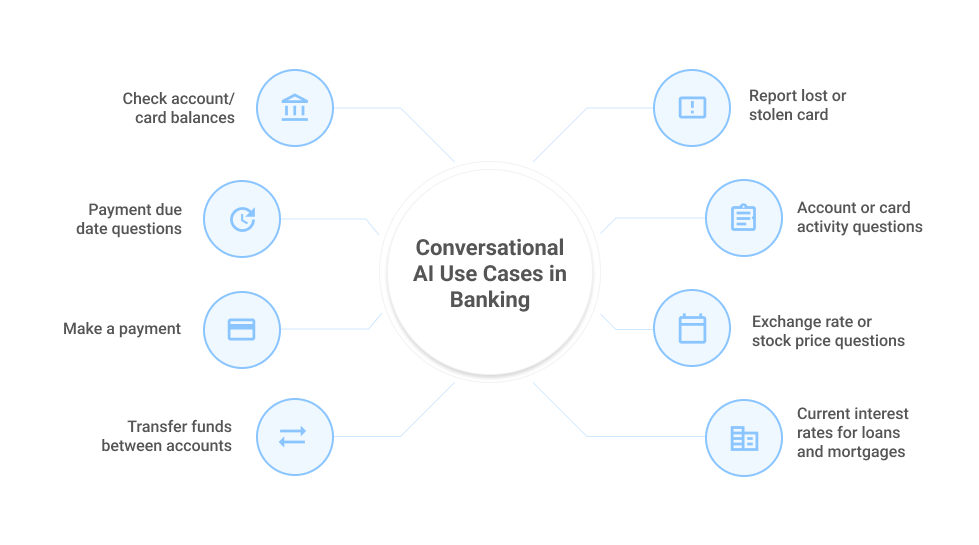

Top Conversational AI Chatbot Use Cases in Banking and Financial Services

Chatbot Use Cases in Banking #1. Checking account/card balances

A great benefit that chatbots’ offer is their ability to solve a myriad of issues and answer questions all in one place, 24/7. With the help of a banking chatbot, banks can cover more personalized requests, AI-powered chatbots request user verification, and only after this, all account information becomes available. Checking account or card balances is a top user request, as 36% of Americans check their balance daily.

Chatbot Use Cases in Banking #2. Payment due date questions

Banking chatbots can easily answer questions around payment due dates, whether it be for bills, loans, or credit cards. According to the FRS, Delinquency Rates under Consumer loans rose to 1,73% in the first quarter of 2022. This number could be even less with the automatization of regular payment and more availability through different channels. AI banking chatbots are able to proactively remind customers of their upcoming due dates to prompt users to make a payment.

With the everyday hectic schedules of Americans, there’s a lot to balance and ensuring all bills are paid on time can be a challenge. Conversational AI solutions address this pain point by offering bill reminders, answer payment due date questions and can even perform payment activities from customer requests. Chatbots can now guide users through paying their bills as they understand their balance and can use saved payment methods on their accounts to make payments once advised to. They also can set up automated payments for customers, leaving them to have one less thing to worry about.

Chatbot Use Cases in Banking #3. Making a payment (e.g: loan or credit card)

Conversational AI integrations of a bank’s backend systems can guide users through the process of making a payment or managing their payment methods. These conversational experiences can actually be faster than a user paying over the phone, website or even an app, due to the agility and speed of a chatbot and its ability to perform a multitude of tasks and actions.

Conversational AI Use Cases — Download Guide for Financial Institutions with Examples.

Chatbot Use Cases in Banking #4. Transfer funds between accounts

Transferring funds between accounts can also be performed also with the help of AI banking chatbot, but even more, it could prevent fraud and cyber attacks. The number of victims of credit or debit card fraud rose to 127 million people in the United States by 2021. Fraud prevention in banks and overall finance is critical, and Conversational AI chatbot has a strong potential for its detection.

A finance chatbot can ask a user questions from the context to prove that the user is not a robot and immediately track the geographical location to check the transaction history. If some of these factors are new, an chatbot can immediately ask the user some of the questions from the previous context to identify that it’s the correct person engaging. If there are some concerns, then a more detailed authentication activity can be involved to verify the user is who they say they are, which may include escalation to a live agent in some cases.

Chatbot Use Cases in Banking #5. Report lost or stolen card

In case a customer loses their credit card, action should be taken immediately to freeze or lock the card. To proceed with this, the client needs to find a relevant phone number and call the credit card issuer. But waiting on a long list for an available live agent — is not the best option for the user, and here is where an AI banking chatbot can support. The user may report their lost/stolen card, check out if the money is still available under the account, and then try to physically find a card.

Chatbot Use Cases in Banking #6. Ask for the most recent charges on an account or card

Another benefit of these banking virtual assistants is that they can track recent transactions and charges, ready to answer these questions from customers about their latest spending activities. According to CNBC, 42% of Americans have forgotten that they’re still paying for a subscription they no longer use and these chatbots can answer questions about subscription charges or list the high spending categories of a user.

Chatbot Use Cases in Banking #7. Exchange rate or stock price questions

Chatbots can easily answer questions related to currencies, exchange rates and stock prices. No longer do customers have to search through different pages on websites or apps. They can simply ask the banking chatbot a question about the markets in real time and get an accurate answer instantly.

Chatbot Use Cases in Banking #8. Current interest rates for loans and mortgages

AI-based banking chatbots offer a viable alternative to human personnel in providing a whole spectrum of information for company services and latest propositions. They can answer queries related to interest rates for loans and mortgages all in real time, giving the most up to date information to customers instantly.

Also read: How Conversational AI Is Changing The Way Businesses Communicate.

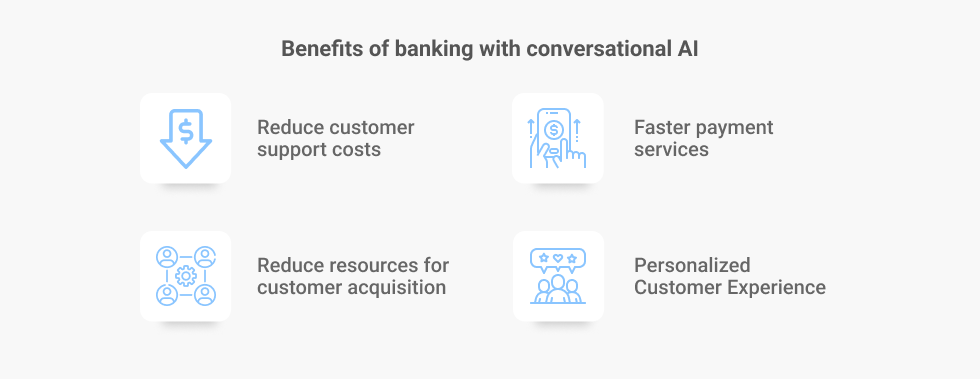

Benefits of Conversational AI chatbot in Banking and Financial Services

Financial Service institutions have been one of the leading adopters of Conversational AI as part of a push to modernize financial services, primarily banking, making them easier to use and more accessible. Let’s take a look at these company-wide benefits of Conversational AI in banking and finance.

- Reduce customer support costs. 6 in 10 financial services and organizations ranked customer experience as their top priority as most consumers say they are more likely to switch service providers for poor customer support. Conversational AI for Finance helps enhance customer experience through 24/7 support. With Master of Code, companies can deploy the most advanced virtual agents for a wide variety of issues.

- Faster payment services are directly tied to higher revenues across the industry. Conversational AI enables businesses to significantly cut down time-to-payment with purpose-built sales bots. Businesses can deploy AI finance chatbots on popular platforms with built-in payments services for instant checkout, expanding the company’s Point of Sale (PoS) systems in the process.

How to Choose Conversational AI Platform. Get the checklist!

- Reduce resources for customer acquisition. The average cost per customer acquisition in the banking industry is USD 300. Financial service organizations can reduce this cost (and time) with the right finance chatbot. AI chatbot implementation for banks leads to a more effective conversation start with potential customers. Chatbots reach a wider audience but have a low cost and minimal effort implementation, thereby reducing the customer acquisition cost.

Check out this Case Study showcasing how a chatbot provides 3x higher conversion rate than a website alone.

- Personalized Customer Experience. 72% of customers rate personalization as “highly important” in financial services organizations. Despite its importance, most modern FSI organizations are unable to customize the customer experience beyond the very basics. FSI companies use AI in finance chatbots to leverage customer data and tailor a customer experience based on their preferences, previous queries, personal details, and all this within a secure infrastructure.

The financial services industry (FSI) is at the forefront of testing and deploying the latest consumer-facing technologies. As a pioneer in Conversational AI, Master of Code is a proud partner for numerous innovating and forward-thinking financial services providers.

1,4 M hours saved with implementing the automated customer service tool Erica at Bank of America. Ready to transform?

Conversational AI Chatbot Use Cases in Banking and Financial Services was originally published in Chatbots Life on Medium, where people are continuing the conversation by highlighting and responding to this story.