By Galen Lewis, Business Development Intern

Conversational AI made it to the big screen in 2013 when Her premiered at movie theatres across the country. The science fiction-romance tells the story of a man who buys an AI-powered operating system for his computer and gradually falls in love with it (or, rather, with “Her”).

Though the movie’s storyline may seem far-fetched, Conversational AI does make it possible for computers to hold human-like conversations, courtesy of natural language processing and machine learning.

At Posh, we haven’t programmed our bots to flirt but we have leveraged Conversational AI to transform customer service, starting at financial institutions. We work with dozens of banks and credit unions to automate their customer interactions 24/7, enhancing their overall customer experience while saving their contact centers tons of time and money.

What does an automated chat look like, and how is it different from a live chat with a real person?

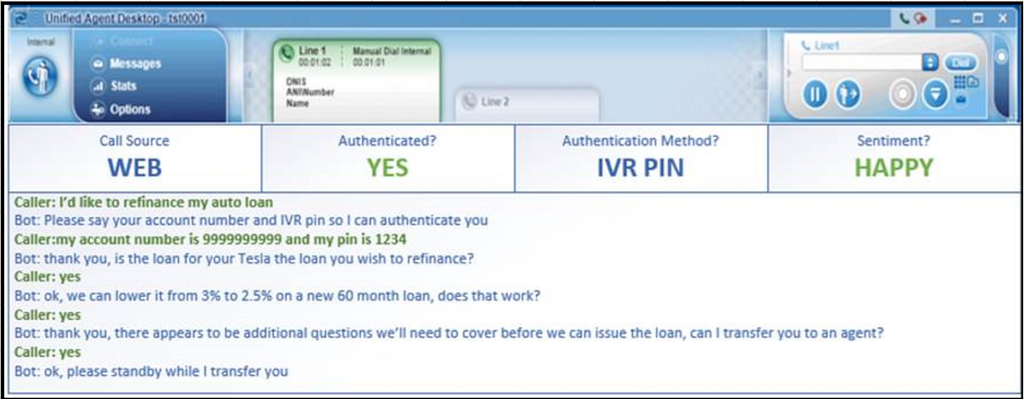

Most people know Posh for our chatbots but we also have a phone bot that automates answers and workflow requests through a natural-sounding (but still automated) voice. This voice replaces the traditional (and really annoying!) touchpad menu. Today, I wanted to concentrate on our chatbots and particularly how they are different from live chats.

For more context before we dive into the difference between our automated chatbots and live chats, automated chats can vary in terms of their complexity. Use cases range from answering relatively simple FAQs to executing more complex workflows.

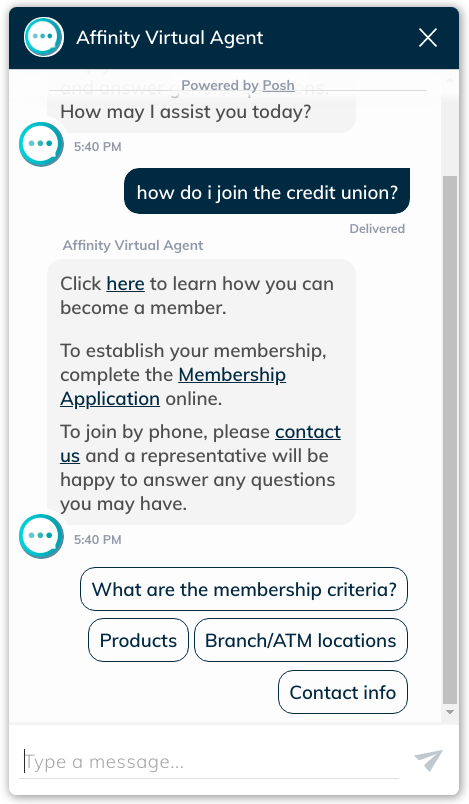

In front of the pin: Simpler automated chats tend to be “in front of the pin,” meaning that these conversations don’t require access to user data. Usually, these chatbots just sit on a website instead of integrating into an authenticated environment like an Online Banking System. Examples of chats that occur in front of the pin include asking for branch hours or requesting information about different kinds of loans.

Behind the pin: What if you want to check a balance, make a transfer, or freeze a card? These kinds of interactions occur “behind the pin” and require access to the user’s account information. These interactions are referred to as “behind the pin,” meaning that the user must authenticate themselves in order to proceed. These chatbots actually sit on and integrate with an authenticated environment like an Online Banking and/or Core System.

Trending Bot Articles:

3. Concierge Bot: Handle Multiple Chatbots from One Chat Screen

But be careful — not all automated chats are created equal!

It’s important to note that not all automated chats are “intelligent”.

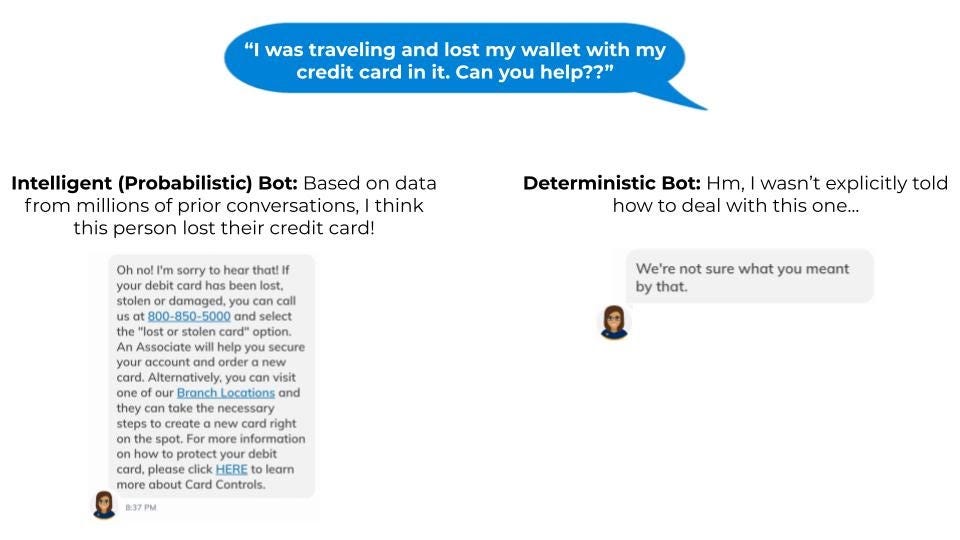

- Deterministic Bots: Some bots are built around simple flowcharts (“If the customer says A, reply by saying B.” “If the customer says C, reply by saying D,” and so on…). These rule-based bots can do well in conversations with a limited number of options, but not in real-life conversations where there are infinite possible scenarios.

- Intelligent Bots: For dealing with all the situations that could pop up in a customer service conversation, probabilistic models are more appropriate than deterministic ones. Posh bots use machine learning and natural language understanding (NLU) to classify customers’ requests into one of many user intents. This means that every chat helps our bots learn and improve to understand more complex inputs from the user. Our AI is trained from the ground up in comprehensive data that is specific to credit unions and banks. This domain expertise sets us apart from many “one size fits all” chatbots that work in a watered down fashion across many industries.

So if Posh is an automated chatbot, what is a live chat and how do they work together?

Live chats: A live chat is an online messaging conversation between a human customer service rep and a customer. Glia, Salesforce, LivePerson, Pegasystems, Oracle, Pure Chat, and ChatBeacon all offer live chat software.

Importantly, automated chats can work in tandem with live chats. At Posh, our AI chatbots have containment rates ranging from 90–97%. In other words, our bot can almost always handle the conversation without involving a human customer service rep. On top of that, our bots are constantly learning. Our containment rates have increased by 10% even since launching in 2018 and we’re not done yet.

In the event that a customer wants to speak to a human customer service rep, though, we can seamlessly transition the customer to live chat. Posh is an open API suite so we can integrate with a variety of live chat providers. After putting the customer in touch with a rep, we arm the rep with the context of the conversation. This way, the customer doesn’t have to repeat something they’ve already told our bot.

What are the tradeoffs between live and automated chats?

Automated chats and live chats each have unique strengths.

Live chats: In favor of live chats, some customers may appreciate the “personal touch” of speaking with a real human with whom they might already have some rapport. Also, some automated chatbots may get confused or misunderstand a user’s question, which can quickly become frustrating for the user.

That being said, customer service is changing and so are consumers’ attitudes towards automation. Given that 21% of live chat requests go unanswered, it’s no wonder that 63% of consumers want AI and automation to play a bigger role in customer service.

Automated chats: There are many arguments in favor of automated chats.

- Immediate Time & Cost Savings: Hiring and retaining call center reps is difficult and expensive. To make things worse, many credit unions and banks have seen call volumes double since the start of COVID-19! Automated chatbots do just that — automate contact center work, saving companies tons of time and money.

- Long-term Scalability: For credit unions and banks who are expanding their customer base, it’s difficult to hire enough human reps to keep up with growth. Human reps can’t work around the clock or handle many simultaneous conversations but a chatbot can!

- Revenue Generation: In addition to saving money, Posh’s bots can help make it! Our bots can generate sales leads and conduct subtle, personalized and targeted marketing campaigns in a conversational way. For example: If our bot knows that a user is between ages 18–23, we could proactively market a student loan!

- Improve Customer Satisfaction: Using a chatbot enables financial institutions to offer 24/7 customer support, optimize agent availability, and decrease wait times, leading to more customer satisfaction.

“Automation cuts costs and brings new levels of consistency, speed and scalability to business processes… time savings of 70 percent. No wonder 84 percent of C-suite executives believe they must leverage AI to achieve their growth objectives.” -Accenture

If you’re interested in learning how Posh can provide your organization with the next generation of customer service, let’s chat!

Sources:

https://www.ibm.com/cloud/learn/conversational-ai

https://www.npr.org/2013/12/19/251951958/a-man-and-his-machine-finding-out-what-love-is

https://gliainc.wistia.com/medias/jwookczoui

https://www.accenture.com/nl-en/insights/artificial-intelligence-summary-index

Live Chat Statistics: Trends and Insights for 2021 | 99firms

Don’t forget to give us your 👏 !

Automated vs Live Chats: What will the Future of Customer Service Look Like? was originally published in Chatbots Life on Medium, where people are continuing the conversation by highlighting and responding to this story.