|

submitted by /u/AcceptableAd2672 [link] [comments] |

Month: April 2021

-

Top Chatbot Development Company in India |Chatbot Development Services in India

-

Common chatbot mistakes

Hi folks! I’ve created a page about common chatbot mistakes and best practices. Is there anything you would add to the list? I’m preparing another material about making mistakes while implementing a chatbot, and I’d like to listen to your thoughts. https://www.chatbot.com/chatbot-best-practices/

submitted by /u/DarDar12

[link] [comments] -

Drafting business requirements for chatbots?

Anyone have any experience implementing chatbots from before/during/after implementation? Ideally this is for a call center and extra credit is also tying in some level of ai/rpa to the mix.

Recently got tasked as a project manager to do this for a government agency and I’m wanting to get a better sense of how to properly draft business requirements or other things to keep an eye out for. Excited, sounds like a lot of fun!

submitted by /u/Deep-Guard-1188

[link] [comments] -

Created a community powered chatbot creator platform now available in closed beta

I developed an interactive chatbot creator website. You can create a chatbot for your Facebook page or for your webpage. My purpose with this is to create a platform which is easier to use then any other existing solution.

It is still in closed Beta, but now you can try it with the registration code: xxx

I hope you will enjoy it. Feel free to ask any questions!

submitted by /u/farkasm1991

[link] [comments] -

Forget Chatbots and Create a Workbot Instead

There is no denying that chatbots have gained enormous popularity over the past few years. From e-commerce to social media platforms, bots are everywhere. Through chatbots, companies are automating various repetitive tasks like sales, customer support, and online banking. But is this enough in generating more leads and getting an edge over your competitors. Chatbots are fully scripted and provide limited options to users/customers.

With the rising complexity of navigating the digital workplace, technology is evolving to offer new routes to the information employees need. Gartner reports that 70% of white-collar workers will interact with conversational platforms daily by the end of 2021. Workbot combines natural language processing with artificial intelligence and adds a human touch to the conversation to provide relevant responses.

Why Workbot is the Future?

The breakthrough in technology has completely changed the way the business communicates with their customers. Organizations are under tremendous pressure to drive customer interactions effectively and respond to their query in minimal time. Gartner reports that virtual assistant usage in the workplace will climb to 25 percent by the end of 2021. To meet your business goals and generate more revenues, companies must implement a system that engages customers more effectively by providing relevant content in the shortest time.

Workbot is your best bet when it comes to creating engaging and interactive conversations. Workbot increases user engagement by using interactive workflows and make the conversation more human-centric. They help businesses in educating their customers about their products, services, and other marketing campaigns.

For example, workbot helps in educating students by providing an interactive learning platform experience to them. It allows the education platform to automate student’s queries, take surveys, and collect their questions. It also allows you to download various multimedia and other documents for a complete visual and interactive learning experience.

Trending Bot Articles:

3. Concierge Bot: Handle Multiple Chatbots from One Chat Screen

Benefits of a Workbot

Technology shift expects businesses to take ownership of the customer engagement process. Optimizing the customer experience and implementing real-time and consistent interactions is the way forward. Workbot does just that by creating a positive and memorable experience at various customer journey touchpoints. It not only brings benefits for businesses but also to learners and customers.

It provides the following benefits to businesses:

§ Help customers learn about your products, services, and marketing campaigns.

§ Help new hires in a smooth onboarding process.

§ Help employees learn organization ethos, Sop’s, and new skills.

It provides the following benefits to learners or customers:

§ Make learning interactive and personalized with sound pedagogical frameworks.

§ Help learners or customers access multimedia or other documents that are useful for further learning.

§ Help learners or customers take surveys to provide feedback.

§ Help students to learn anytime from any location.

Are People Ready for Workbots?

Do you find pre-coded chatbot responses irrelevant? Are you struggling to find information using chatbots because of their rigid conversational structure? If yes, then the adoption is expected to be quick and easy. Workbot adoption also depends on how well a workbot engages users and improves customer experience.

Users often lose their interest when they must choose options that are pre-coded and are irrelevant. If it continues to do so, users may completely abandon it. Workbot is quite helpful here. As it utilizes natural language processing, it can drive the conversation better. NLP relates thoughts, intent, language, and pattern and responds accordingly.

Conclusion

Botspice workbot takes away the effort of coding and building your brain to drive the conversation. It allows you to modify the workflow and deploy your workbot in minimal time. If you are curious to learn more, reach out to our expert and start your journey with a workbot.

Don’t forget to give us your 👏 !

Forget Chatbots and Create a Workbot Instead was originally published in Chatbots Life on Medium, where people are continuing the conversation by highlighting and responding to this story.

-

ONBOARDING WORKBOT- SHORTEN TIME TAKEN TO ANSWER EMPLOYEE QUERIES BY 50%

Onboarding Workbot-Shorten Time Take To Answer Employee Queries By 50%

Onboarding is a tedious and laborious administrative process. A new hire often has multiple questions before joining a company. Understanding the policies, functionality and, processes of an organization is the no-so-exciting part of the new job, however the most important.

According to a study, up to 20% of all new hires resign within the first 45 days of their role, representing an enormous loss for the business in terms of time and money spent on recruitment.

There are several reasons why new hires decide to cut their time short:

- Expectations created that are unsettled from the time of recruitment.

- Lack of clarity about their roles.

- Autocratic management process.

- Limited opportunities for self-development.

Workbot- Powering the Future of Work!

Forrester Research mentioned that 87% of CEOs are looking to modernize their HR department using Artificial Intelligence bots.

Onboarding Workbot by Botspice engages employees and prepares them for their roles to the point of acceptance. Maintaining employee engagement from the critical first day and into the future as well.

Workbots can direct your HR team’s attention to more strategic and impactful work and ease the onboarding process of new employees and effectively automate 80% of the HR processes.

Reducing 50% reduction of the time spent responding to common HR questions.

Transforming HR department processes from a cost center operation to a money-spinner!!

Trending Bot Articles:

3. Concierge Bot: Handle Multiple Chatbots from One Chat Screen

Workbot’s can help employees:

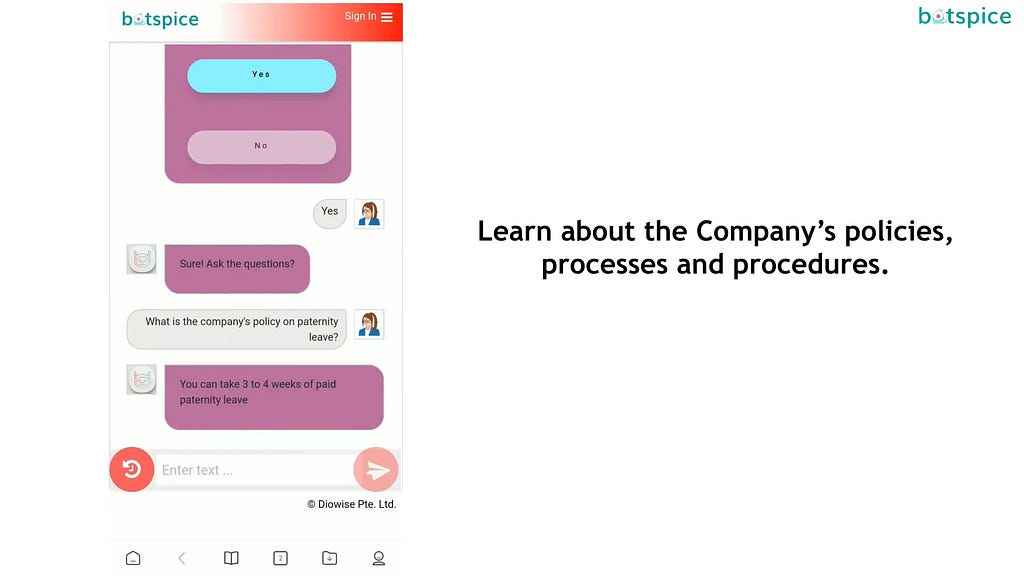

· Learn about the Company’s policies, processes, and procedures.

Workbot’s help employees understand the company’s policies and can ask questions without depending on the HR team, simple tasks like knowing a process, joining a company activity can be done with the help of a Workbot.

Employee- “What is the company’s policy on parental leave?”

Workbot — “You can take 3–4 weeks of paid paternity leave”.

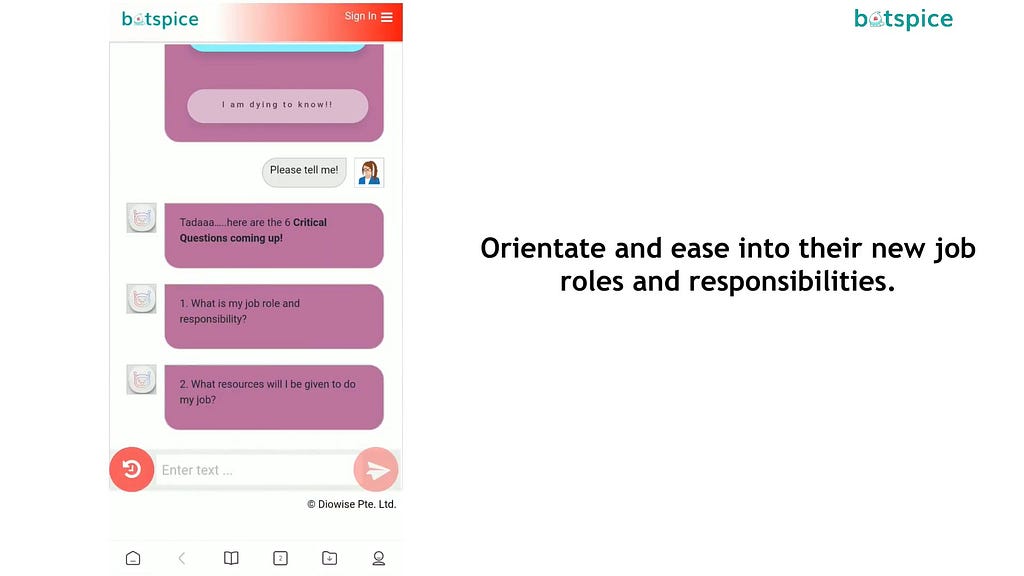

· Orientate and ease into their new job roles and responsibilities.

Orientation comes under the job responsibility of HR they guide the employee about the expectations and roles of their job. This however needs coordination with various departments for making sure onboarding is not just apt but also personalized. Such a process can be made easier for the onboarding employees with Workbot holding the new hire.

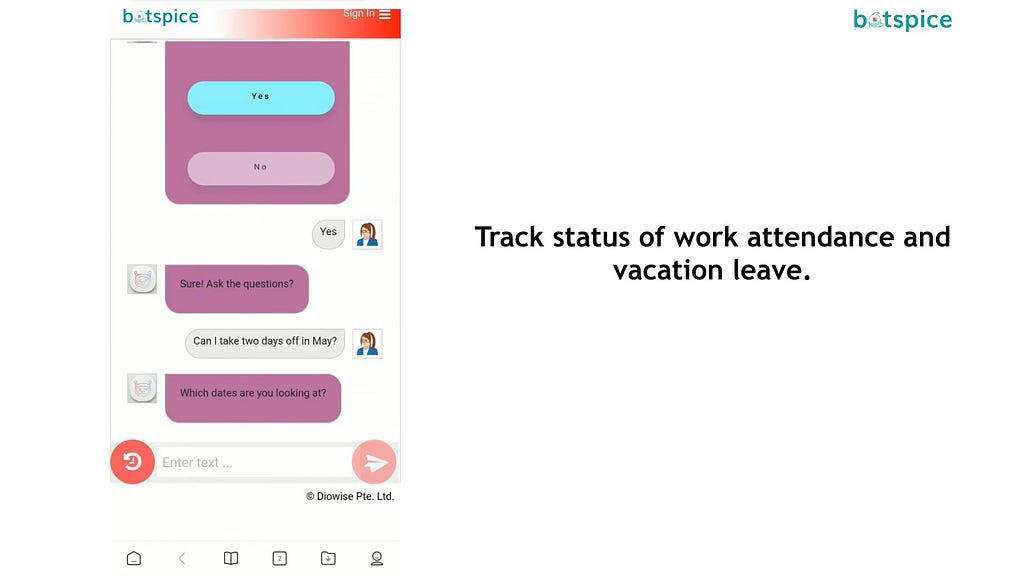

· Track the status of work attendance and vacation leave.

Workbot simplifies leave and attendance inquiries with an AI-powered chat interface enabling employees to request leaves and getting them approved instantly without having to navigate through a portal.

Employee- “Can I take two days off in May?”

Workbot- “Which dates are you looking at?”

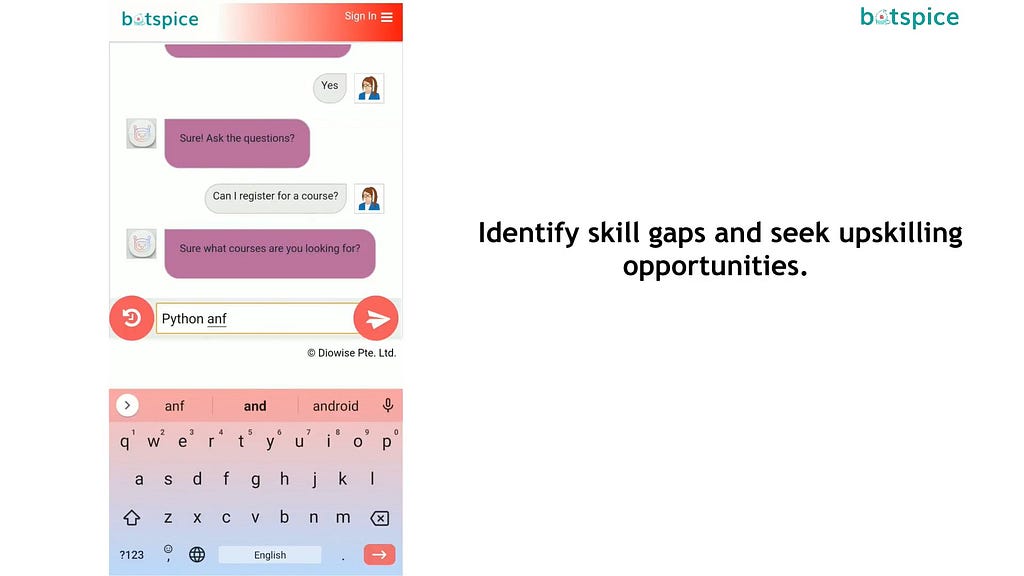

· Identify skill gaps and seek upskilling opportunities.

Onboarding Workbot can make learning and training easier by instantly answering queries put up by the employees. These can be followed by quizzes and Multiple questions and answers to evaluate the employees’ learning capabilities. Workbot’s can also send the team updates and information regarding an upcoming learning course offered by the company.

Employee- “Can I register for a course?”

Workbot- “Sure what courses are you looking for”

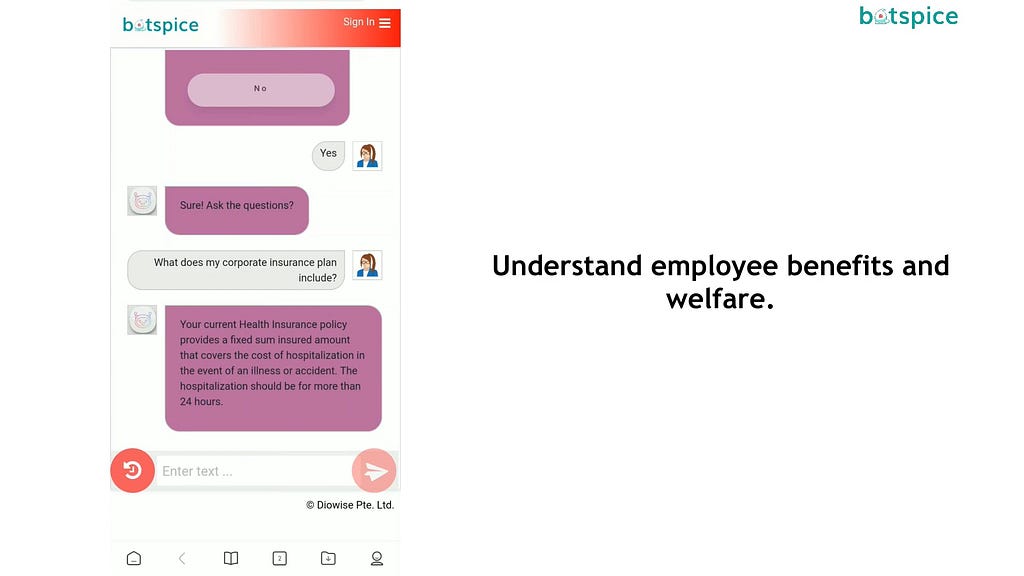

· Understand employee benefits and welfare.

Workbot allows employees to manage their insurance claims quickly and efficiently and help employees understand the benefits the company offers.

Employee- “What does my corporate insurance plan include?”

Workbot- “Your current Health insurance provides a fixed sum insured amount that covers the cost of hospitalization in the event of an illness or accident. The hospitalization should be for more than 24 hours.”

Why Botspice?

A Workbot with Artificial Intelligence is the best solution to add value to employee experience while reducing operational costs.

With Botspice you can easily create your AI-powered conversational HR Workbot with a no-code platform that is easy to implement across multiple channels. A Workbot that can be trusted and answers concurrent questions through personalized cerebral conversations is what you need to change your company’s onboarding game!

Build a Workbot for Onboarding today!

Visit, www.botspice.com

Don’t forget to give us your 👏 !

ONBOARDING WORKBOT- SHORTEN TIME TAKEN TO ANSWER EMPLOYEE QUERIES BY 50% was originally published in Chatbots Life on Medium, where people are continuing the conversation by highlighting and responding to this story.

-

How Are Chatbots Effective in the Banking Sector?

credit appinventiv.com Do you know what irritates the customers when they visit their nearest banks? It’s their poor customer service. Clients want their queries to get resolved soon, but long response time and lack of free operators make them switch from one bank to another. If you want your customers to stick with you, you must ensure that you provide them excellent customer service. One way banks can deliver exceptional customer service to their clients is through chatbots.

Chatbots are known for boosting customer experience and, at the same time, helps bank staff in automating their routine work so they can focus on other important work. With this, they attract more new customers. It’s all because now chatbots have emerged more mature and secure. Before, chatbots only deal with customers’ predefined questions. But, now, advancement in Artificial Intelligence technology has transformed these bots into digital assistants.

To aid our readers more in this regard, let’s dive into this article and dig out more about how chatbots are useful in the banking industry. But, before that, let’s first discuss the role of chatbots in the banking sector.

Role of Chatbots in the Banking Sector

The following mentioned below are some of the most significant roles of chatbots in the banking sector:

- Cost-Effective: Chatbots are a one-time investment, and that cost is less than hiring a digital assistant in person. Like other separate apps, chatbots need less coding, which means low cost and is also supported by a wide range of platforms.

- 24/7 Support Center: The 24/7 support feature of the chatbots attracts the customers the most. All those banks that support this feature can hold their customers for a more extended time.

- Provide Suggestions on Financial Matters: Some banks are now using advanced bots to access customer data. These bots track how much the customer spends, manages their budget, and sets spending limits. Such bots also offer recommendations for money management. Isn’t it great?

- User-Friendly: Compared to other traditional apps, chatbots are user-friendly, easy to use, and offer a personalized user experience. There’s no download process while using chatbots. All this is because of AI and ML technology.

Trending Bot Articles:

3. Concierge Bot: Handle Multiple Chatbots from One Chat Screen

Five Effective Uses of Chatbots in the Banking Sector

With the progress in AI technology and the conversational approach, chatbots can now communicate with customers. Like any other sector, there are several practical uses of chatbots in the banking sector as well. Here, mentioned below are some of them. Let’s discuss them one by one.

Chatbots Supports Essential Banking Activities

The advanced chatbot helps the customers manage the necessary banking activities such as EMI installments and collect the loan payments within the chat window. This function is the most effective use of chatbots in the banking sector. Your clients appreciate you for having someone who deals with all such work and is present around the clock at any time. Moreover, chatbots allow customers to make transactions, pay an invoice, and even apply for a loan by communicating with a bot.

Chatbots are known to handle transactional activities, and they securely do this job. They don’t make any errors while making transactions. Isn’t it great? You should take care to test your chatbot solutions before you make them live to avoid any further inconvenience.

Personalized Banking

Gone when customers visit the bank and the first thing that annoys them the most was waiting in long queues and personalization. For this reason, many of them switch from one bank to the other. But, with the arrival of chatbots, there’s much ease in bank employees’ and customers’ lives.

Chatbots offer a personalized banking experience to their customers. The customers don’t have to visit the banks quite often to inquire about their account balance, update their credit card details, know about the latest schemes, and get the monthly statement. Chatbots do all these tasks. It saves much time and leads to a higher customer experience level and more business productivity.

The bank statements and credit card bills have a PIN code, which only you know, and you can access the main document after entering the main document. Banks take this initiative because of the increasing threat landscape and prevent different kinds of cybercrimes and social engineering techniques like phishing. Thus, it is the customer’s responsibility to set a complicated password to break by any malicious agent. For a more secure browsing experience, while they use their banking services, users can use a VPN service that makes them anonymous over the web and encrypts their data traffic.

Chatbots Improves Customers Onboarding Process

Banking chatbots also help customers in filling out application forms for different purposes. Be honest, and answer. Don’t customers get frustrated when they witness that the entire application form process is time-consuming? Of course, it is. Many customers often complain about this to the bank manager, but all in vain.

But, with AI chatbots, this problem can get fixed. The AI-based chatbots offer help in requesting the customers for the needed documents and images at the time of form filling. The customer onboarding process brings new opportunities for businesses to enroll in more new customers. While this process through chatbots results in higher usage rates, which is a plus point for the banking sector.

Measuring Customer Satisfaction

Nowadays, the majority of people use mobile banking apps. No doubt, these apps have their worth and are also in need of time. The biggest drawback of these apps is that it’s impossible to get customers’ feedback about your service. Users usually open the apps when they need them and close them once the work is finished. You can’t figure out your services, and either they need improvement or customers are satisfied with them or not.

But, with chatbots, there comes a solution as well. Chatbots offer specific tools that ask the customers for rating their services. The AI chatbots by asking questions like; was this conversation helpful for you? identifies the users’ behavior patterns. They gather massive user data about their moods, preferences, and behavioral patterns. In this way, banks get a chance to improve their services and introduce new ones if needed. Their main aim is to provide users a more personalized approach that leads to more conversion rates.

Improves Customer Service

For customers to stay loyal to your brands, it’s essential to take care of customer needs and demands. Both business growth and customer relationships go hand in hand. At times, customers do face issues about fixed deposits or transactions. In such a situation, all they need is a quick response. Before, it wasn’t possible, but with the emergence of chatbots, customers now receive satisfactory responses to their problems that, in a nutshell, are proof of improved customer service.

As mentioned above, the most significant chatbots feature is that they are available 24/7 to provide solutions. It’s most welcoming from customers’ perception as well. Suppose a customer has lost their credit/debit card, and he needs to block it urgently. They don’t have to wait to visit the bank for this. The AI-powered chatbots provide them quick help in this matter.

Final Thoughts

To sum up, most organizations think that deploying chatbots risk their employees’ jobs. This is a big misconception. Chatbots are there to assist the employees. They automate most of their routine tasks and allow them to focus on other vital tasks. This not just saves much time but also brings more business opportunities.

The banking sector is now shifting more towards the adoption of chatbots. There are several benefits of having chatbots in the banking sector. Chatbots engage clients, save their time, and improve the customer experience. Moreover, they’re available whenever you need them. They have come out as a versatile tool that is improving the banking sector in many ways.

Don’t forget to give us your 👏 !

How Are Chatbots Effective in the Banking Sector? was originally published in Chatbots Life on Medium, where people are continuing the conversation by highlighting and responding to this story.

-

[QUESTION] Bot Builder for an undergraduate CS student

Hi everyone, for context I am doing taking an undergraduate CS course and need to build a chatbot to address a problem in either medical, food, disaster or education domains. I have been advised by my lecturer to use a chat-bot builder such as Verbot, Sequel, Chatfuel and other similar builders. The chat-bot should be an expert system to address problems in these domains. So I will need to map a knowledge base and prove that there is information exchange between the bot and user as well as some learning capabilities.

As a chat-bot novice, I have no prior experience with chatbots, but I do have C,C# and python programming experience. I would really appreciate it if you guys could give me advise on how to choose a beginner friendly chatbot to help me. Also there are no restrictions on platform integrations for my project 🙂

submitted by /u/Star4cE1991

[link] [comments] -

Chatbots for Learning: Ways to Gamify Chat-Based Learning Environments

Chatbots for Learning: Ways to Gamify Your Chat-Based Learning Environment

Chatbots have been steadily gaining attention for their cost- and time-saving benefits in customer service and sales support roles. With the correct application of chatbots, businesses are able to automate repetitive tasks and optimise their operational processes, while simultaneously creating a positive customer experience.

-

List of Best Finance Chatbots from around the World

Finance chatbots can provide support anywhere in the world to any user. They are available 365 days a year and can answer a question 24/7, solve common issues quickly like, resetting a password, managing transactions, or finding the nearest open office. Chatbots can handle multiple requests at a time. They decrease user waiting time and resolution time. Chatbots save 4 minutes per inquiry as compared to traditional call centers.

Here’s a list of Best Finance Chatbots :

submitted by /u/tech_guru_678

[link] [comments]